Background on Trump’s Tariff

Trump’s tariff policies involved levying additional taxes on a wide range of imported goods, which, according to his administration, would encourage consumers and businesses to buy domestic products. The tariffs also had a direct impact on international trade dynamics, as countries retaliated with their own tariffs, subsequently influencing global markets. For example, agricultural products faced challenges in the wake of retaliatory tariffs from foreign nations, affecting farmers and rural economies.

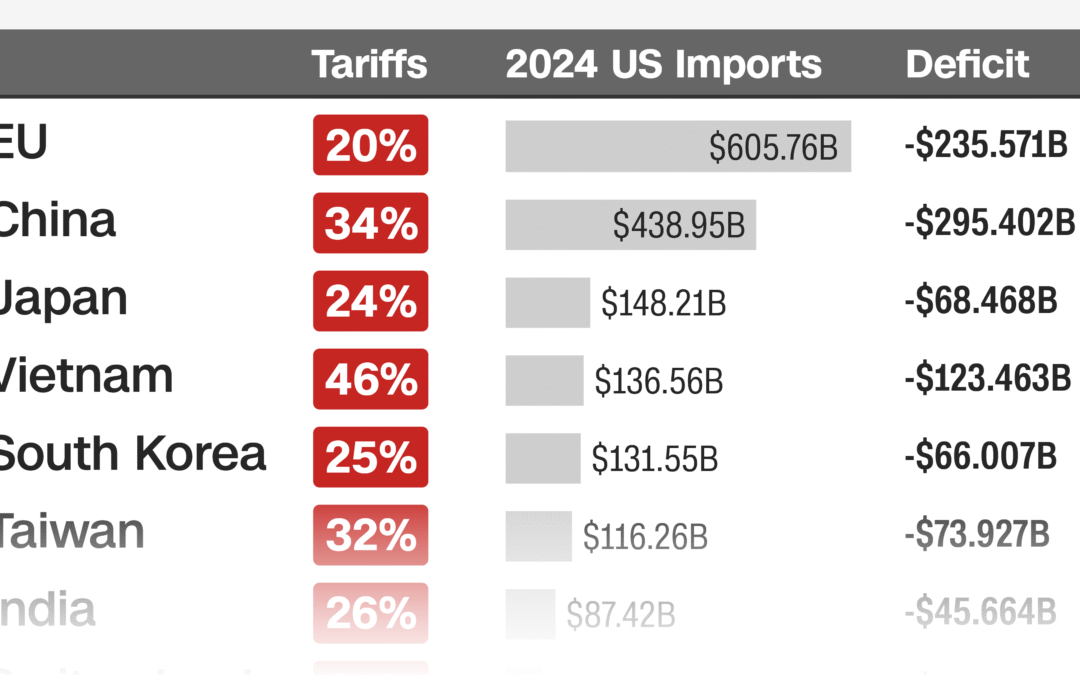

During his presidency, Donald Trump implemented a series of tariffs aimed at reshaping America’s trade relationships, particularly with countries such as China, Canada, and Mexico. The rationale behind these tariffs was multifaceted, focusing on protecting domestic industries, rectifying trade imbalances, and promoting American manufacturing. The tariffs were often framed as a necessary measure to safeguard American jobs and stimulate economic growth, a stance that resonated with a significant segment of the electorate.

One area particularly affected by these tariff changes was the chemical import and export sector, which includes substances such as caluanie muelear oxidize. The implementation of tariffs led to increased costs for businesses relying on imported chemicals. This shift prompted some companies to seek alternatives, including the exploration of domestic producers offering caluanie muelear for sale within the US. The increase in tariffs not only influenced pricing strategies but also led to supply chain disruptions, as businesses adapted to a new economic landscape.

As economic theories would suggest, these tariffs were intended to boost local production, but their actual effects were often contested. Critics argued that such trade policies could lead to higher prices for consumers and strained relationships with key trade partners, resulting in an unpredictable market environment. Therefore, navigating the implications of these tariffs required a nuanced understanding of both domestic economic interests and global trade policies.

Understanding the Trump’s Tariff Structure

The U.S. tariff structure during Donald Trump’s administration was multifaceted, involving the imposition of various types of tariffs aimed primarily at protecting domestic industries. These tariffs can be classified into general tariffs and those targeting specific categories, such as chemical products. In the context of chemical imports like Caluanie Muelear Oxidize, the tariffs not only influenced pricing but also determined the feasibility of enterprises engaging in international trade.

General tariffs apply uniformly across a range of products, while specific tariffs were levied on certain imports, impacted by the U.S.’s trade relationships with different countries. The Economic Policy Institute highlighted that the tariffs on chemical products, including substances like Caluanie Muelear for sale, were significantly higher than on other goods, thereby affecting the profitability and pricing strategies for these chemicals in multiple markets.

Particularly, the tariffs imposed on Caluanie Muelear Oxidize led to increased costs for buyers. Those looking to buy Caluanie Muelear from the U.S. faced higher prices attributed to these tariffs, which inevitably affected the international exchange and competitive positioning of U.S. chemical producers. The varying rates of tariffs were also contingent upon existing trade agreements; countries that maintained favorable trade terms with the U.S. could experience reduced tariffs on imports, in contrast to those facing more stringent trade restrictions.

These policies reflected Trump’s broader strategy aimed at reducing trade deficits and boosting domestic production, but they also complicated the landscape for international buyers and distributors. Understanding these dynamics is crucial for stakeholders operating in the chemical industry, especially when navigating the complexities of tariffs affecting goods like Caluanie Muelear Oxidize.

Impacts on Caluanie Muelear Oxidize Exporters

The implementation of USA tariffs has significantly influenced the landscape for exporters of Caluanie Muelear Oxidize. Initially, these tariffs have resulted in increased production costs, as manufacturers and exporters face higher prices for raw materials and components necessary for production. This surge in expenses often leads to a corresponding increase in the sale price of Caluanie Muelear Oxidize. Consequently, customers may seek alternatives or turn to non-domestic suppliers, potentially impacting the overall demand for caluanie muelear for sale in the international market.

In terms of export volumes, many companies have reported a decline due to market reactions to the elevated prices resulting from tariffs. As businesses assess their global competitiveness, some exporters may face limitations in their ability to maintain previous levels of export volume. This decline challenges companies to adapt their strategies, including exploring new markets, forging alliances, or enhancing supply chain efficiencies. Exporters of caluanie muelear oxidize must remain vigilant and responsive to these fluctuating dynamics to ensure sustainability in a competitive landscape.

Moreover, the imposition of tariffs has introduced potential market restrictions, creating a complex regulatory environment for exporters. As companies navigate these restrictions, they may encounter challenges such as delays in shipping and increased bureaucratic hurdles when exporting Caluanie Muelear Oxidize. This situation directly affects freight costs and delivery timings, leading to potential customer dissatisfaction and a decline in repeat business. Furthermore, shifts in supply chains are inevitable, as businesses reconsider sourcing strategies to mitigate the impact of tariffs. Some exporters may explore options to buy Caluanie Muelear from US suppliers at lower costs or establish partnerships with entities that facilitate smoother international transactions.

Overall, the effects of USA tariffs on the exportation of Caluanie Muelear Oxidize cannot be understated. The ripple effects span increasing production costs, reduced export volumes, regulatory challenges, and necessary supply chain shifts, ultimately requiring exporters to innovate and adapt in response to an ever-evolving marketplace.

Effects on International Trade Relations

Donald Trump’s imposition of tariffs during his presidency significantly transformed the landscape of international trade relations, with notable implications for the sale of caluanie muelear oxidize from the USA. These tariffs, aimed at protecting domestic industries, had far-reaching consequences, particularly for commodities and chemicals, including caluanie muelear for sale. As countries faced increased costs for imports, trading partners commenced a reevaluation of their economic ties with the United States.

Firstly, the introduction of Trump’s tariff led to retaliation from affected countries, altering the dynamics of trade negotiations. Many nations that import caluanie muelear oxidize began to seek alternatives to US suppliers, which diminished their reliance on American products. This shift not only affected the sales of caluanie muelear but also strained longstanding international alliances. Countries that had previously maintained favorable trading relationships with the US found themselves at a crossroads, forcing them to explore new markets or strengthen ties with competitors.

Moreover, geopolitical tensions escalated as nations perceived these tariffs as an affront to their economic sovereignty. Trade disputes arose, resulting in prolonged negotiations and sometimes even legal challenges within international trading forums such as the World Trade Organization. Importers looking to buy caluanie muelear from the US faced challenges presented by these tariffs, complicating straightforward commercial transactions.

Additionally, as some countries reduced their imports from the US, the overall production and distribution networks for caluanie muelear oxidize saw significant adjustments. Domestic manufacturers also felt the pinch, as they grappled with a changing supply chain landscape, often needing to pivot their marketing strategies to reestablish relationships with international clients.

In conclusion, Trump’s tariff reshaped the landscape of international trade, fostering a climate of uncertainty that influenced key relationships and the flow of products like caluanie muelear oxidize. The geopolitical ramifications of these tariffs extend beyond mere economics, affecting diplomatic relations and strategic partnerships in a rapidly evolving global market.

Market Reactions and Adaptations

Since the implementation of Donald Trump’s tariffs, the market for Caluanie Muelear Oxidize has experienced significant fluctuations. Producers and consumers alike have had to navigate the complexities introduced by these tariffs, which have directly influenced the pricing dynamics for this chemical compound. For those looking to buy Caluanie Muelear from the US, the added cost implications due to tariffs have led to a reassessment of purchasing strategies. As a result, businesses involved in the sale of Caluanie Muelear Oxidize have adopted various tactical measures to mitigate the tariffs’ impact.

One of the primary market responses has been the adjustment of pricing structures. To maintain competitiveness, sellers of Caluanie Muelear for sale have had to contemplate increasing their prices, which could deter potential buyers. Companies are assessing their profit margins and considering how to balance the increased costs associated with tariffs while retaining their customer base. This has prompted some sellers to offer discounts or promotional deals on bulk purchases as they seek to sustain demand despite the economic pressures from tariffs.

Furthermore, businesses are exploring alternative markets outside the USA to soften the blow of Trump’s tariff. By diversifying their customer base internationally, companies can reduce reliance on the American market and exploit regions where tariffs are less prohibitive. This shift in market focus can not only enhance revenue streams but also provide a buffer against future tariff fluctuations.

In addition, many firms are investing in advocacy efforts aimed at influencing tariff policy. By collaborating with industry associations, they strive to present a united front in lobbying for fairer trade practices, hoping to persuade policymakers to reconsider tariffs that adversely affect the sale of Caluanie Muelear Oxidize. These actions reflect a broader trend in adapting to an ever-evolving landscape shaped by economic policies.

Caluanie Muelear Oxidize is an innovative chemical compound that has gained prominence for its versatile applications across various industries. Primarily known for its effectiveness as a reagent in several industrial processes, Caluanie Muelear Oxidize plays a crucial role in the chemical manufacturing and mineral extraction sectors. With a molecular structure that allows it to participate in diverse chemical reactions, it has emerged as an essential material in contexts ranging from metal processing to pharmaceuticals

https://caluaniemuelear.com/

https://caluaniemuelear.com/product/caluanie-muelear-oxidize-5liters/

https://caluaniemuelear.com/product/caluanie-muelear-oxidize-100liters/

https://caluaniemuelear.com/product/caluanie-muelear-oxidize-50liters/

https://caluaniemuelear.com/product/caluanie-muelear-oxidize-20liters/

https://caluaniemuelear.com/product/caluanie-muelear-oxidize-10liters/

https://caluaniemuelear.com/product/caluanie-muelear-oxidize-1-5liters/

https://caluaniemuelear.com/product/caluanie-muelear-1-liter/

https://caluaniemuelear.com/chemicals/

https://caluaniemuelear.com/caluanie-muelear-made-in-usa-the-global-demand/